A Comprehensive Guide to the Santander Share Price Trends Predictions and Investment Insights

The Santander share price is a point of interest for investors, financial analysts, and banking sector enthusiasts worldwide. Banco Santander S.A., one of the largest financial institutions in Europe and the world, has consistently drawn attention due to its global presence, diversified financial services, and stock market performance. Understanding the factors influencing the Santander share price can offer valuable insights for making sound investment decisions.

This article provides a complete overview of the Santander share price, its historical performance, influencing factors, expert forecasts, and whether Santander stock is a viable long-term investment.

Let’s explore this topic in detail.

What is Santander Share Price?

Santander Share Price is a multinational commercial bank and financial services company headquartered in Madrid, Spain. Founded in 1857, it has grown into one of the most significant players in the global banking industry.

Key Facts:

- Founded: 1857

- Headquarters: Madrid, Spain

- Industry: Banking, Financial Services

- Global Presence: Europe, North America, Latin America, and Asia

- Stock Listings: Madrid Stock Exchange (SAN), New York Stock Exchange (SAN)

The Santander share price is listed on multiple exchanges and is a component of major indices, including the Euro Stoxx 50.

Historical Performance of the Santander Share Price

Pre-2008 Financial Crisis Boom

Before the global financial crisis of 2008, Banco Santander was performing strongly. The share price peaked due to aggressive expansion in Latin America and Europe.

2008–2012: Recession and Recovery

Like most banks, Santander’s stock took a hit during the 2008 crisis. The European debt crisis further affected the Santander share price, causing volatility and uncertainty in investor sentiment.

2013–2019: Stabilization and Moderate Growth

The post-crisis period saw gradual recovery. Banco Santander diversified further, improving its risk exposure and returning to profitability, which reflected modest growth in its share price.

2020: COVID-19 Impact

The pandemic caused global market downturns, and Santander was no exception. The share price dropped significantly due to decreased loan demand, increased defaults, and lower interest rates.

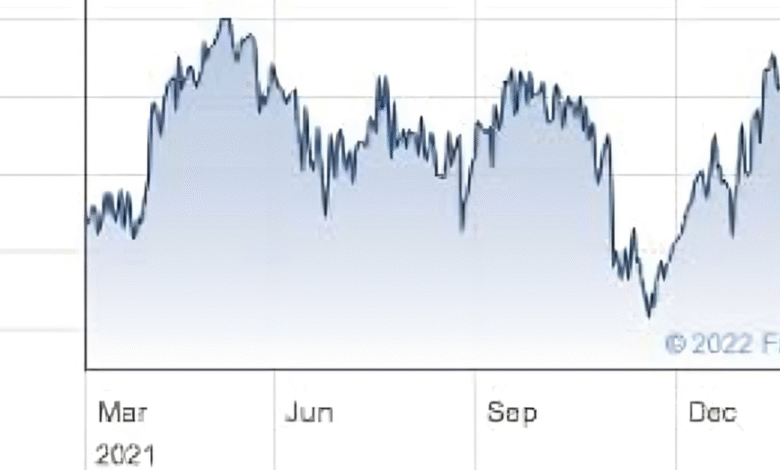

2021–2024: Rebound and Restructuring

The bank responded with digital transformation, cost-cutting, and strategic refocusing, helping the Santander share price recover. As of 2024, the company has shown resilience and stable earnings, supporting a more positive market outlook.

Factors Influencing the Santander Share Price

Understanding what drives the Santander share price helps investors forecast and make informed decisions.

1. Global Economic Conditions

As a multinational bank, Santander is deeply affected by global economic trends. Recessions, inflation, and interest rate changes in key markets (such as Spain, Brazil, and the UK) impact performance.

2. Interest Rates

Banking stocks typically perform well in rising interest rate environments. Higher rates mean greater profit margins on loans.

3. Currency Exchange Rates

Operating in multiple countries, currency fluctuations affect earnings and the reported financial performance, influencing investor perception.

4. Regulatory Environment

Tighter banking regulations in the EU or other operating regions can increase compliance costs or restrict operations, potentially lowering the share price.

5. Dividend Policy

Banco Santander’s dividend strategy is another vital factor. High or consistent dividends attract income-focused investors, boosting the share price.

6. Competition and Innovation

The bank’s competitive standing in the fintech space, its digital transformation efforts, and market share growth can positively affect its valuation.

Current Status of the Santander Share Price (As of 2025)

Note: Always check live data from a trusted financial source for real-time prices.

As of July 2025, the Santander share price has stabilized around mid-to-high single digits in EUR, trading between €3.80 and €4.60 over the past few months. Analysts view it as fairly priced based on current earnings and market conditions.

Analyst Predictions: What’s Next for Santander?

Short-Term Forecast (2025)

Many analysts suggest a cautious but optimistic outlook for 2025, expecting the Santander share price to rise moderately due to:

- Interest rate normalization

- Continued cost-efficiency initiatives

- Solid performance in Latin America (especially Brazil and Mexico)

Projected price range (by year-end 2025): €4.50 to €5.20

Medium to Long-Term Forecast (2026–2030)

For longer-term investors, the following growth drivers could significantly influence the share price:

- Continued digital innovation

- Expansion in emerging markets

- Strategic acquisitions or partnerships

- Recovery in European lending and credit card usage

Some projections indicate the Santander share price could reach €6–€7 by 2030 if economic conditions remain favorable and strategic goals are met.

Santander Stock: Dividend Yield and P/E Ratio

Dividend Yield

Banco Santander has traditionally paid attractive dividends. In recent years, it resumed payouts after pandemic-era restrictions, currently offering a dividend yield of approximately 4.5%–5.2%.

Price-to-Earnings (P/E) Ratio

The P/E ratio of Santander ranges between 7 and 10, depending on quarterly earnings. This suggests the stock might be undervalued compared to other global banks, making it an appealing option for value investors.

Is Santander Stock a Good Investment?

Pros:

- Strong international footprint

- Consistent dividends

- Low P/E ratio indicates potential undervaluation

- Increasing digital capabilities and fintech competitiveness

- Exposure to high-growth markets in Latin America

Cons:

- Vulnerable to global economic shocks

- Currency volatility risks

- Heavy regulatory scrutiny

- Slow growth in European markets

Overall, for long-term investors seeking exposure to banking, especially with geographic diversification, the Santander share price offers a potentially lucrative opportunity, especially when bought during market dips.

Comparison With Other European Bank Stocks

| Bank | Market Cap (EUR) | Dividend Yield (%) | P/E Ratio |

|---|---|---|---|

| Banco Santander | ~€60 Billion | 4.5 – 5.2 | 7 – 10 |

| BNP Paribas | ~€70 Billion | 4.0 – 4.8 | 8 – 11 |

| Deutsche Bank | ~€25 Billion | 3.5 – 4.0 | 9 – 13 |

| ING Group | ~€45 Billion | 4.2 – 5.0 | 8 – 10 |

Santander holds its own among European peers, offering competitive dividend yields and valuation multiples.

How to Buy Santander Shares

If you’re considering investing based on the current Santander share price, here’s how to proceed:

1. Choose a Brokerage Account

Look for one that provides access to the Spanish stock exchange or U.S. investors can buy ADRs listed on the NYSE under ticker: SAN.

2. Analyze the Stock

Use financial tools to assess Santander’s fundamentals, trends, and analyst ratings.

3. Determine Investment Amount

Only invest what aligns with your financial goals and risk appetite.

4. Execute the Trade

Use market or limit orders depending on your strategy. Consider setting up dividend reinvestment plans (DRIP) if available.

Expert Tips for Monitoring the Santander Share Price

- Use stock trackers like Yahoo Finance, Bloomberg, or Google Finance

- Set alerts for price changes or dividend announcements

- Read quarterly reports and earnings calls

- Follow macroeconomic news affecting interest rates and global banking

FAQs About Santander Share Price

Q1: Where can I check the current Santander share price?

You can check the on financial websites such as Yahoo Finance, Bloomberg, Reuters, or your brokerage platform. It’s listed on the Madrid Stock Exchange and NYSE under the ticker SAN.

Q2: Is Santander a dividend-paying stock?

Yes, Banco Santander is known for offering dividends. The current yield ranges between 4.5% and 5.2%, depending on market conditions and profit results.

Q3: Is the Santander share price undervalued in 2025?

Based on the low P/E ratio and stable earnings, many analysts consider Santander undervalued, especially for long-term investors seeking value and dividends.

Q4: What are the risks of investing in Santander shares?

Risks include exposure to global economic downturns, currency fluctuations, geopolitical tensions, and regulatory changes in Europe and Latin America.

Q5: Can U.S. investors buy Santander stock?

Yes. U.S. investors can purchase Santander’s American Depositary Receipts (ADRs) listed on the NYSE under the ticker symbol SAN.

Conclusion

The Santander share price reflects more than just numbers on a screen—it encapsulates the health of one of the world’s largest banks and serves as a barometer for economic trends across several continents. With a diversified portfolio, strong dividend policies, and an increasingly digital approach, Santander presents both challenges and opportunities for investors.

Whether you’re a seasoned investor or just entering the stock market, keeping an eye on the and understanding the forces that drive it is essential for making informed financial decisions.